By Rob York and Emma Hsu

Published On 3 Apr 2022

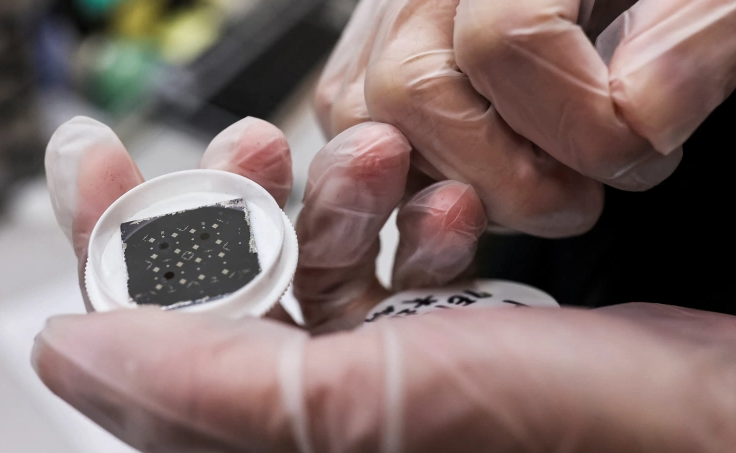

The COVID-19 pandemic and the war in Ukraine spotlighted the value of semiconductors in the global economy and Taiwan’s crucial role in manufacturing the chips.

They have also showed that the island’s role in producing the crucial components, which are used in everything from smartphones to medical devices and cars, would be hard to fill.

Taiwan’s vital importance to global supply chains is especially pressing amid growing speculation that China could try to take the self-ruled island, which Beijing considers a renegade province, by force in the coming years.

Among Taiwan’s manufacturers, the Taiwan Semiconductor Manufacturing Company (TSMC) alone accounts for more than half of global revenue generated by semiconductor foundries, thanks largely to a business model that focuses exclusively on manufacturing chips designed by other companies.

Douglas Fuller, an expert in technological development at the City University of Hong Kong, said Taiwan got a “first-mover advantage” and retained it by recruiting a strong team of engineers – and making sure its education system emphasises engineering – and receiving “a lot of government support” in the form of cheap access to water, subsidised loans and low taxes.

Part of how TSMC maintains such support, Fuller told Al Jazeera, is in the implicit threat that it could move its operations elsewhere.

Taiwan’s role in semiconductor manufacturing is so important that, as demand grew with the onset of the pandemic – during which technology kept education and the professional world running – economies including the United States and Germany asked for Taiwan’s help in stepping up production.

Experts have pointed to its semiconductor manufacturing industry as a key factor in Taiwan’s rising stature that helps distinguish the island from China.

Such recognition is crucial for Taiwan, which has full diplomatic ties with just 14 states, and many countries have been hesitant to deal with Taipei out of fear of angering Beijing in light of its statements that the island must be reunited with the mainland, by force if necessary.

Antoine Bondaz, research fellow at France’s Fondation pour la Recherche Stratégique, says European countries, in particular, have started speaking about the need for greater cooperation with Taiwan, something he attributes to semiconductors specifically. “Semiconductors played a key role in making Taiwan visible,” Bondaz told Al Jazeera.

“It’s completely new that Taiwan can be talked about openly.”

Following Russia’s invasion of Ukraine last month, Taiwan joined the US and its allies in imposing economic penalties on Moscow by playing the highest card in its deck – cutting off semiconductor exports.

The move is likely to leave Russia struggling to find alternatives, according to industry experts.

“It’s important to note that semiconductors are not just used for computer processors – they’re required for a range of other functions such as data storage, sensing and signal conversion,” John Lee, director of the East West Futures consulting firm in Germany, told Al Jazeera.

“So the potential impact on Russia’s economy is very severe if the current sanctions coalition can be maintained.”

While supply chain disruptions prompted by COVID – not to mention the ongoing great power competition between the US and China – may cause other countries to reevaluate their dependence on Taiwan, analysts question whether TSMC can be replaced in the foreseeable future.

South Korea’s Samsung, the No. 2 player, comes a very distant second in terms of semiconductor foundry revenue. Beyond Samsung, United Microelectronics Corporation (UMC), also of Taiwan, vies with GlobalFoundries, of the US, for third place.

‘Cannot be surpassed’

Chien-huei Wu, an associate research fellow at Academia Sinica in Taipei, questioned whether another country could replicate Taiwan’s role, pointing to the island’s special institutions for training semiconductor engineers and TSMC’s 24-hour research and development operations.

“This cannot be surpassed, even compared to Samsung,” Wu said, adding that diversification efforts elsewhere would sooner or later run into pitfalls related to energy costs, labour costs, and the inability to replicate Taiwanese engineers’ efficiency.

Eric Yi-hung Chiou, an associate professor of international relations at National Yang Ming Chiao Tung University in Taipei, concurred.

“It’s not about the money, it’s not about the technology,” Chiou told Al Jazeera. “It’s about the talent. … working five days a week, eight hours a day, that will be very difficult. We have more engineers more willing to sacrifice their private time.”

There is one potential threat to TSMC’s position in the market that security analysts are increasingly talking about – the possibility of Beijing launching an invasion of Taiwan.

With Taiwan’s pro-independence President Tsai Ing-wen now in her second term, Taiwanese political culture becoming more assertive of its distinct democratic identity, and China’s efforts at both cooperation and intimidation falling flat, there is growing speculation Beijing may choose to attempt reunification by force.

Most security analysts believe the likelihood of such a scenario is low in the short term but may increase over time.

Beijing has, in the meantime, sought to claim a greater share of the semiconductor market, though Fuller of the City University of Hong Kong, for one, questions whether or not it will be successful.

Fuller also expressed doubt that it can seize Taiwan’s capacity for semiconductor production by force, even if it successfully suppresses Taiwanese resistance: Facilities such as TSMC’s might be destroyed in such an outcome, and if not, their equipment requires continual servicing, including from the US and partner nations.

But Taiwan’s importance in the semiconductor supply chain would not necessarily offer a “silicon shield” should Beijing decide to invade, according to Lee.

“Most countries are not going to come to Taiwan’s defence against an attack from China on account of Taiwanese firms’ role in the semiconductor supply chain,” he said.

Fuller said semiconductors would be “pretty low down on the priority list for Chinese reasons to attack.”

Such an event would deal a blow to the industry as a whole, inflicting a short-term crunch in supply should operations need to shift from Taiwan to another location such as South Korea.

Taiwan’s annexation would likely also raise major questions about regional security – manufacturers would “need to question if moving capacity to Korea is that safe anyway”, Fuller said.

SOURCE: AL JAZEERA